Alternative search engines to reach the luxury market

Should the luxury market “care” about optimising for alternative search engines? Are they relevant to the luxury industry?

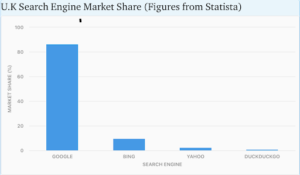

Google reigns supreme in the UK, US, and most of Europe (see graph below of UK leading search engines as of September 2021 sourced from statista) dominating an intimidating 86.31% of the market share. ‘To Google’ can even be used as a verb, which shows just how synonymous it has become with searching online.

However, there is an awareness, and growing interest, that there are alternatives that might offer other benefits. Google’s privacy policy is clear that they collect and store data from searcher behaviour, either to improve user experience or for targeted advertising. As awareness has increased of how much search engines track user information and behaviour, interest has grown for search engines that offer more privacy, censor less and can even boast environmental benefits.

When we talk or read about SEO, the focus is mostly on Google, even when discussing search engines generally. As industries move to personalise content on an increasingly individual level, consider whether you are optimised for the minority that use these alternative search engines.

Defining the luxury audience

What do we know about the search preferences of luxury audiences?

- High Net Worth Individuals (HNWIs) are internet and tech savvy

We know HNWIs own more devices than the general population and access the internet multiple times a day. In PWC’s 2016 report they found that 85% of HNWI use 3 or more digital devices daily.

This means the majority of HNWIs are highly tech literate and might use search disproportionately more than the rest of the market. Along with this comes a growing awareness of the search landscape and desire for a search experience aligned with personal motivations.

- HNWI are likely to be eco-conscious

Increasingly, HNWI are looking to brands that align with their passions and interests, as marketing techniques become more granular in the audiences they target. According to Mckinsey’s State of Fashion Report, 9 out of 10 believe that brands should articulate where they stand on environmental and social issues.

If we know that they consider these environmental and social issues when making a purchase, it makes sense that they might consider this when researching said purchase online.

- HNWI are generally privacy conscious

Along with a high net worth comes access to a range of private services– from private members clubs to exclusive platinum members benefits. Privacy-focused browser Brave not only blocks ads and cookie trackers, but also has a reward program allowing users to earn tokens. These can then be spent on gift cards, crypto or NFTs.

This desire for a private experience speaks to not only separating from the masses but also, well, privacy and not necessarily being visible while doing this. As the population at large continues to become more aware of how their behaviour is tracked online this trend won’t dissipate any time soon.

CNBC recently estimated that nearly half of millennial millionaires have 25% of their wealth invested in cryptocurrencies, as the crypto boom continues to create wealth. This demographic might be especially inclined to use search tools that make blocking easy and also offer rewards.

Do luxury audiences all use Google?

Given that Google has such a large portion of the market, it would be reasonably safe to assume that the majority of HNWIs also fall into this segment. It’s still the main search engine to be targeting in your campaigns and to ensure you are optimised for.

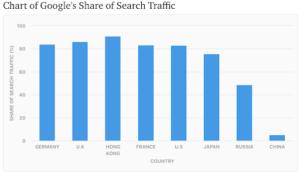

However, this statement really only holds true for the Western part of the world, which doesn’t encompass all luxury audiences. The graph below shows search queries coming from Google (relevant April 2021) in countries other than the U.K.

Given that China is the second largest wealth market in the world, and that this is expected to grow by 46% in the next 5 years, it is significant that Google only accounts for 5% of Chinese search queries.

Less than half of Russian searchers use Google. Instead, Yandex is the most popular search engine, with a market share of 50%. Home to a significant number of wealthy individuals, fourth on Wealth X’s list, it’s also worth considering if you can optimise for this as well.

The fastest growing market for wealthy individuals is Asia, making Japan a relevant market to consider. Although Google is the most popular search engine here, Yahoo also counts for a significant share at 20% – much more than in westernised countries.

Even if you’re not currently active in these markets, it’s worth considering these might be future areas of investment. Or if you are, it’s worth investing some of your team’s time and energy to continue to optimise for the search engine most popular in this market.

What are the alternatives to Google?

There are an enormous range of alternative search engines out there, ranging from the well-known (Yahoo, Bing) to the fairly obscure (Qwant, Swisscows, Ekoru). For simplicity, we’ve selected some of the more widely known that could be most applicable to HNWI personas and attempted to explore correlations between these and their search engine of choice.

-

The search engine for HNW financiers and high-tier professionals

A well-known alternative to Google, Yahoo strives to be a one-stop search engine for “news, email and search”. It also includes certain services not offered by Google, such as Yahoo Answers which allows users to ask and answer each other’s questions.

Yahoo Finance provides high quality financial content on the stock market, business news and cryptocurrencies that appeal to HNWI business owners, financiers and those involved in the stock market. Overall, it’s targeted at high-tier professionals by offering them everything conveniently in one place.

-

The search engine for affluent white collar professionals

Operated by Microsoft, Bing is a widely known alternative search engine. It is unsurprisingly integrated as a default for all of their products, as well as for Amazon Kindle and Alexa voice assistant.

Dozens of search engines partner with Bing (including Yahoo and Ecosia on this list) so you might even be using it without knowing it! Most importantly, this means it will be the default search engine for PC users, which include the more mature white collar top-tier professionals.

From a functional perspective it offers fewer features than Google, however, it is regarded by some as the better alternative for visual search. Bing’s algorithm is selective over higher quality images and provides more information when compared with Google.

-

The search engine for privacy conscious tech moguls

DuckDuckGo is marketed as the search engine that cares about privacy, they don’t track searcher behaviour or target advertising. It is probably one of the best known alternative search engines offering increased privacy features.

The general public is increasingly aware of how their online behaviour is tracked and the data collected, and of how this information might be used. Privacy issues and the knowledge that data is fast becoming the most valuable currency has led many to increase caution in their online activities.

This likewise appeals to a wide range of HNWIs as well as those involved in the tech industries, celebrities and the independently wealthy.

-

The search engine for environmentally conscious Gen Z

For the eco-conscious, Ecosia uses its advertising profits to plant trees all around the world but especially where they are needed most. Combined with increased security from encrypting all searches (which Google and Bing do not do) it’s an attractive option for some, even if it’s the lesser known on this summary.

There are many alternative search engines that use pledges to the environment to win their audience. This might appeal to a number of HNWIs, but most specifically millennials and Gen Z. This demographic is expected to account for 130% of growth in the luxury market, and so represent a key driver of the changes to come in the industry.

What do you do differently to optimise for search engines other than Google?

Most search engines use similar algorithms for ranking content and follow the same principles, so optimisation essentially remains the same. Factors such as domain authority, trust and relevance are still just as important for your overall ranking across all search engines.

This means your search strategy is not likely to have to adapt significantly, regardless of the search engine preferences of your particular market segment. However, many search engines have their own tools for monitoring and somewhat controlling how a website is displayed in that particular search engine’s results.

If your market is particularly likely to rely on Bing, Yahoo, Yandex or others, your SEO team should spend some time setting the site up in those search engine tools and ensuring it is indexing without issues.

Check for low hanging fruit opportunities

Though the tactics will be similar for alternative search engines, the opportunities could be different. Because most resources tend to be invested in ranking on Google, it’s possible that there are pockets of opportunity elsewhere. You could rank for topics here where competition is lower than on Google.

Data can then help ensure you’re covered. Most website user tools (like Google Analytics) will show you details about the search engines that are driving traffic to your site. Looking specifically at how likely searchers from other engines are to convert can help you identify whether you need to channel additional SEO efforts towards a particular search engine.

For example, if the average conversion rate via Yahoo is double that of Google, you might have a smaller but more engaged audience there. Shifting some of the optimisation resources towards Yahoo specifically, might bring in more of this traffic and therefore increase revenue proportionately.

Look at the big picture

All of this needs to be considered within the big picture of your SEO strategy. Be mindful that working with smaller numbers can affect the reliability of the data. An average conversion rate based on 10,000 visitors tends to be a more reliable indicator than one based on 100 visitors.

While Google is unlikely to be knocked off its throne anytime soon, it’s still important to consider which alternative search engines might be important to your market. Then you can upload the relevant sitemaps and have visibility there as well, capturing valuable traffic.

Please get in touch via our form to arrange an informal chat to see how we can help you with your digital marketing.